Essential Care Products & Finance

We aim to make vehicle ownership as simple and flexible as possible.

Choose from our wide range of essential care products all designed to match your purchasing needs.

Personal Service Plans

Our Personal Service Plan enables you to avoid the concerns of annual service bills by paying a monthly direct debit and spreading the cost. This is calculated specifically for the requirements of you and your car.

Once your plan is set up and your next scheduled service is due, book your service as normal with your Dealer and the cost of the service will be paid from your Personal Service Plan fund.

What are the key benefits?

- Flexible payment options (monthly or upfront)

- Inflation proof

- 20% Discount on parts, labour and fluids

- Fully qualified technicians

- Latest updates and diagnostic equipment

- Free puncture repairs

What will it cost?

Your anticipated mileage and period of ownership are entered into the Personal Service Plan system and your monthly direct debit amount is calculated for you based on current parts and labour rates.

Alternatively, you could pay as a lump sum in advance.

How do I apply?

If you have not already been offered a quote you can speak to any member of our sales or service teams at our dealerships and they will be happy to calculate a plan that is personal to your individual requirements or you can now buy online.

Comprehensive Maintenance, Inspections, Repairs and Assistance

Like 4 Like provides you the motoring experience that you would normally expect from a manufacturers extended warranty.

Grange Maintained

Grange Maintained – Fair about maintenance.

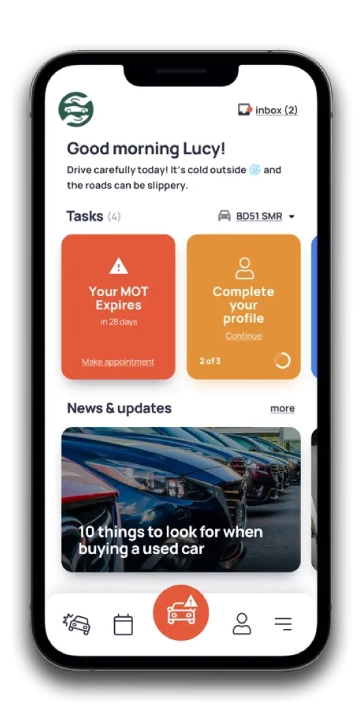

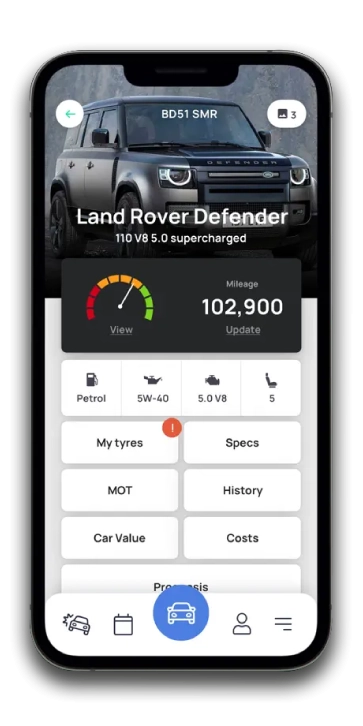

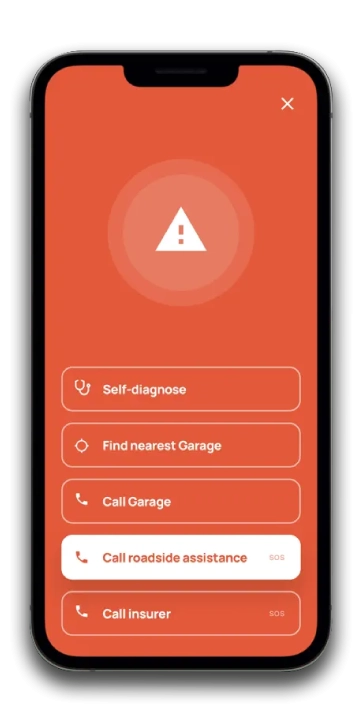

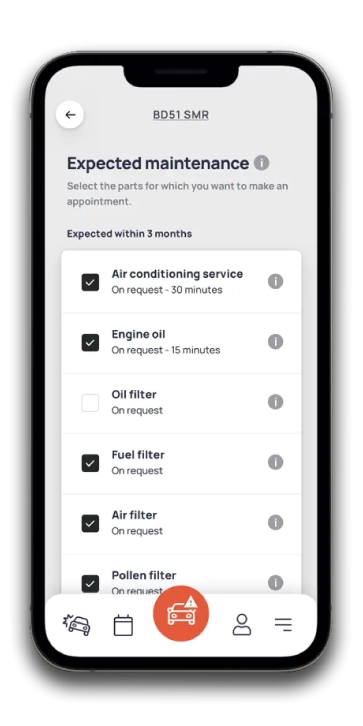

Exclusive to Grange Jaguar and Land Rover, everything about your car conveniently gathered in one APP

Grange Maintained provides comprehensive maintenance, inspections, repairs and assistance.

GardX - Car Paint and Fabric Protection

GardX provides the ultimate paint and fabric protection for your vehicle. You will never have to polish your vehicle again once treated with GardX.

The GardX Vehicle Protection System (VPS) provides valuable protection for your vehicle, enhances its future re-sale value and comes with the assurance of a Lifetime Guarantee

Cosmetic Maintenance Plan

Our innovative cosmetic maintenance plan has been designed to provide regular scheduled attendance for the visual appearance of a vehicle.

The plan will provide 4 quarterly maintenance inspections per annum, it will comprise of a cleanse and visual check on the items listed in below to ascertain whether these items.

- Check bonnet

- Check boot

- Check front bumper

- Check rear bumper

- Check all exterior door panels

- Check all quarter panels

- Check condition of all wing mirror casings

Tyre & Alloy Protection

Our tyre and alloy wheel maintenance plan has been designed to provide regular scheduled attendance for the visual appearance of alloy wheels and the general condition of the tyres.

The GardX Vehicle Protection System (VPS) provides valuable protection for your vehicle, enhances its future re-sale value and comes with the assurance of a Lifetime Guarantee

PCP Finance Explained

An introduction to Personal Contract Purchase

HP Finance Explained

An introduction to Hire Purchase finance